Background

Lassonde Stage Valuation

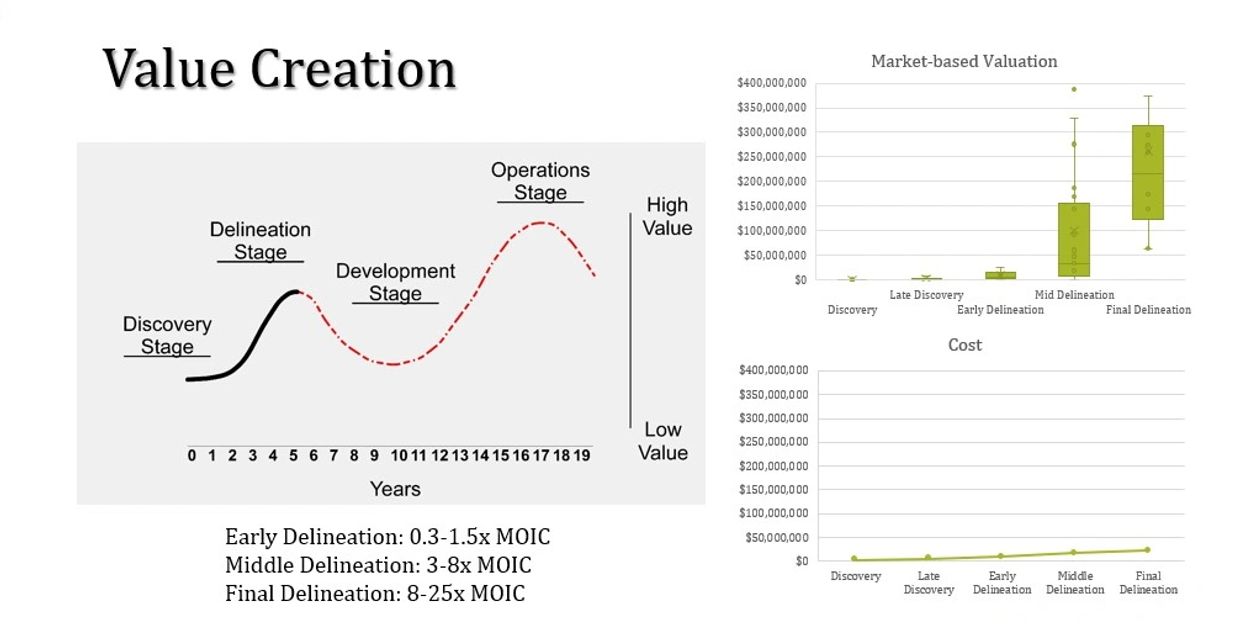

The financier Pierre Lassonde published this graph a number of years ago, showing qualitatively how project values fluctuate over time.

Building on Lassonde's qualitative framework, we have quantified value creation by analyzing real-world transaction data (e.g., property sales, joint ventures, and acquisitions) reported in mining news, databases, and regulatory filings. This approach uses the market approach to valuation—benchmarking against comparable deals—to assign dollar figures to the Lassonde discovery and delineation stages.

Returns escalate exponentially—from 0.5x at initial discovery to over 20x at full delineation—as data reduces uncertainty.

Key Components

Risk Diversification

- Spreading investment across multiple projects mitigates the risk of relying on a single project’s success

- This portfolio approach mirrors real estate development, where multiple properties are evaluated and developed to find high-value opportunities

- Hybrid Financing Strategy

Staged Investment

- Projects progress through delineation stages (e.g., Middle Delineation Stage 1, Final Delineation Stage 3) based on merit

- Early divestment of underperforming projects preserves capital and locks in modest profits

- High-performing projects generate exponential returns

Continuous Pipeline

- As projects are completed or divested, new ones are added, maintaining a dynamic portfolio

- This approach ensures ongoing opportunities to capture high returns without dependence on any single project reaching the final stage

Applied Technology

- Proper application of proven methods, supplemented by advanced technologies, like 3-D Seismic and ANT enhances traditional exploration methods, enhancing targeting and improving the accuracy of resource delineation

- Drill the best targets first

Hybrid Financing Strategy

- Preferred share, tied to a specific project

- Secured by a specific project, like a PE fund

- Fixed coupon, debt-like downside protection

- Convertible into underlying common, immediately liquid

- Conversion is a call on the entire project portfolio of the parent, company treasury, management skill

- Hedging opportunities, an investor may control their MOIC

- Participating on exit, 3- to 5-year timelines

- Redeemable, with a put-like protection

The Omnia Strategy

This hybrid structure is arguably the most creative ever proposed to fix the broken junior mining finance model. It features strong fundaments and, if executed carefully, could become the “Blackstone of mining” for the discovery and delineation of mineral resources.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.